Fintech Investments in 2025: Where to Grow Your Finance or Investment Business This Year

Interested in the top Fintech investments and where to grow your finance or investment business this year?

This is an excellent question that we will answer here.

You should have noticed the ever-increasing speed of company failures in recent decades.

In the past, it used to take a significant time for a company to fail after being left behind by the market.

No doubt you know several companies, such as high street shopping chains or electronic product manufacturers, which have now completely vanished.

One obvious example of this is the entire British car industry, which despite once being a global leader, now only manufactures low numbers of exclusive cars for carmakers, most of which are foreign-owned.

This demise, however, took many, many years.

Now consider the software industry. From Netscape to MySpace, companies that are unable to compete or fail to innovate, literally vanish overnight.

Most of you have heard the story where Blockbuster executives foolishly laughed at the offer to buy Netflix for the paltry sum of $50,000,000. Today, the Blockbuster stores that haven’t been occupied by other companies have been torn down and turned into parking lots.

Get a complimentary discovery call and a free ballpark estimate for your project

Trusted by 100x of startups and companies like

This is just one of the many stories that highlight the need for companies to always be forward-facing and innovative. No matter what your industry is, and the size of your company, the penalty for not having a fintech business plan in place and so being left behind is enormous.

The solution is to evolve your company by implementing new technologies.

In this article, we are going to take a closer look at exactly what fintech trends 2025 has in store for the financial industry and beyond to give you an idea of the changes that you will need to be prepared for if you wish to evolve and grow your business.

We will also examine why, whatever the size of your company, you cannot afford to be left behind, particularly as there is currently so much potential in the market space for new fintech products like financial and investment management solutions.

Fintech: Leading the Way Into the Future

The rapid evolution of the fintech industry demands that companies always be investing in their future. The fintech market revenue forecast for 2025 is set to run into hundreds of billions of dollars.

The act of adding a simple feature such as a customizable user interface to a trading solution, or artificial intelligence to a cryptocurrency trading bot, can see a relatively small fintech solution rocket to success, leaving the competition in its wake.

While a company might be hesitant about such levels of continuous investment, companies such as Netflix (which invested heavily in its AI-powered recommendation system) and Amazon (which was the first to enter the cloud solutions business) prove how big the rewards for success can be.

This year is set to be yet another record year for fintech companies. Expect to see numerous companies rise seemingly out of nowhere to become highly successful.

According to a multitude of recent studies, the growth and application of fintech solutions are set to be one of the key drivers of global economic growth from this year onwards.

Such is the buzz around the potential of fintech in 2025 that industry insiders are calling it a new gold rush.

One report by Mordor Intelligence highlighted that “A large majority of global banks, insurers, and investment managers are planning to partner with financial technology companies over the next 3-5 years, and expect a 20% average return on investment on their innovation projects.”

Given that in the U.S. and Canada, the digital payment fintech segment alone was worth over US$1.2 trillion in 2019, the return on investment for fintech investors is expected to be enormous.

Fintech Trends in 2025

Where, just a few years ago, fintech solutions were all about offering lower-cost solutions within financial industry verticals, this year, fintech companies are expected to continue the fintech trend of expanding horizontally into completely new industries.

One trend that seems indisputable is that fintech solutions are going to continue their expansion drive across industry horizontals in order to satisfy user demand.

Today, most of us use some form of fintech solution, with an ever-increasing number using multiple solutions.

The race is already on to amalgamate all these fintech solutions into one platform. Not only will this allow users to deal with all their financial transactions under one roof, but for the companies that succeed in this market, it will offer gigantic financial rewards.

While we are unlikely to see any ubiquitous solution for all financial services emerge in 2025, there will be a huge amount of cross-service integration, as well as huge advances in the following 5 fields.

Let’s list some of the use cases the future of fintech in 2025 will bring.

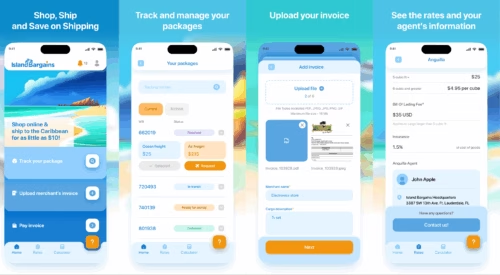

Advanced Payment Systems and Trading Terminals Powered by Fintech

If you're the CEO of a trading company such as an investment firm or hedge fund, you will find huge opportunities in developing a custom-built trading system for managing your investment portfolio.

The amount of fintech/bank collaboration is expected to rise significantly in 2025.

While the figures are already impressively high (70% of all financial institutions in Germany had a fintech relationship in 2017, 54% in the U.S, and 43% in the U.K), in 2025, fintech companies are expected to focus a huge amount of effort in expanding the list of services that they offer.

If the investment figures are anything to go by then it seems that the largest area of growth and development in fintech in 2025 will revolve around payment and trading systems.

Keep in mind that mobile wallet payments totaled $708 billion in 2017, growing significantly in both 2018 and 2019, and you can see just how important this industry segment is.

A recent Forbes article highlighted that ‘Global Stock Markets Kick Off Good Start To 2023’. This means that traders will be busier than ever if this trend continues.

Custom-built solutions allow traders to easily access both current and historical data at their workstations. Such a feature offers advantages that need no explanation. Using conventional or off-the-shelf solutions from other companies often hinders this ability.

Hire expert developers for your next project

1,200 top developers

us since 2016

Also, in 2025, the integration of AI-driven trading features into broker-focused trading software is expected to continue. This will continue the graduation of investment firms towards ever-increasing automated fintech ETF trading platforms.

Along with reducing the human resources required, some main advantages of this approach include the following:

- Ability to backtest using historical market data

- Preserves discipline

- Achieves consistency

- The improved order entering the speed

- Diversified trading

If you are a company that is looking to get the edge in this highly competitive market in 2025, then it’s time to consider an upgrade to your systems to allow your traders to trade faster, with more information, and without the stress of having to do everything manually.

Recently, a California-based investment group leveraged this trend by building a trading and brokerage platform for stocks and bonds that are traded in a FINRA-regulated environment.

They hired an expert development team from DevTeam.Space in order to get the project built quickly and to the highest quality standards. You can find more details about the project here.

Blockchain and Fintech

If you're part of the senior management in a fintech startup or enterprise then the integration of blockchain solutions into your platform will create massive new opportunities for you to better serve your existing customers and win new ones too.

One area that we will see go from strength to strength in 2025 is blockchain-based solutions that leverage smart contracts to automate processes such as payments or property transfers.

Blockchain-powered fintech solutions promise to dramatically reduce the overheads for customers on activities such as stock and asset trading, selling homes, managing supply chains, paying salaries, etc.

One area that is already being explored by companies such as Ripple is international payments, which at the current time are expensive and lengthy due to anti-fraud checks that are required by law.

Blockchain-based ID solutions that utilize smart contract automation promise to massively reduce transfer times and costs in the near future. A recent article in Forbes claimed that “blockchain's business value-add is projected to grow to $176 billion by 2025, according to Gartner Inc.”

The race is on to develop such solutions in order to become the first to dominate this very lucrative market.

A Singapore-based private investment group developed and launched an algorithmic trading solution for large-volume traders that allows cross-trading on four major crypto exchanges.

This cutting-edge exchange allows clients to undertake custom order building while empowering them with all the technical indicators and information that they need to trade.

In order to get this project to the marketplace as quickly as possible, they hired an expert development team from DevTeam.Space.

Thanks to its cutting-edge approach, features, and its fintech business model, this solution is now doing well in the marketplace. Learn more about the project here.

Investment Platforms and Fintech

Those of you CEOs who have already seen the massive returns on the investment platform segment of the fintech market will understand just how much the software market has revolutionized this once-exclusive market.

Where once only professional traders could invest in money and stocks etc., today, millions of people manage their own portfolios via online investment platforms.

While there are a number of well-established and reliable investment platforms already available, they remain largely focused on a single industry vertical.

Companies such as Coinbase, which offers its clients the chance to trade in a range of cryptocurrencies, will need to diversify their offerings if they are to stay ahead of the competition this year and beyond.

There are a number of startups currently racing to develop cross-platform solutions that will merge industries such as real estate, bonds, stocks, payments, etc.

This industry segment has enormous growth potential for those who can find a niche in the market and create an appealing trading solution.

One recent example is Freetrade, which recently announced its move into Europe’s fee-free stock trading markets. The company’s valuation, as well as profits, are expected to increase massively this year as a result.

It seems certain that investment platforms will be a key area of growth in the future of fintech 2025, as well as for the long term future as well.

Real Estate Investment Platforms Will Benefit From Fintech

As a CEO or manager in a real estate company, you will have seen just how fast technology is changing your industry. Today, top real estate companies offer everything from online 3D tours of properties to the ability to sell a home entirely using cryptocurrency.

Hire expert developers for your next project

Given just how much the real estate industry is set to change over the next few decades, companies must evolve to stay ahead. All aspects of the industry are set to be affected, from sales, and rentals to management and payment.

In 2025, the drive to offer buyers from all over the world to undertake 3D VR tours of properties that are on the other side of the world will be one of the leading growth segments. Companies already offering this service have reported a surge in sales.

This has been attributed to 5 main advantages VR tours have over conventional promotional methods:

- Instant Engagement With Buyer

- Gives A Better Visual To Prospects

- Help Prospects Take A Decision In Their Own Time

- Avoids Unnecessary Visits And Rejection

- Technological Advantage Over Competitors

Only last year did DevTeam.Space completes the development of a real estate platform that is already helping its owner to grab a significant foothold in the real estate market.

It involved us completely updating a simple promo website to include a state-of-the-art user interface that included cutting-edge features like integrated ACH payments, OFAC checks, an e-signature plugin, legal papers, payouts, and the ability to add new properties, and a user dashboard that displays projected earnings.

Within a very short space of time, the website was completed and deployed to the production environment where it was integrated with the client's salesforce.

Trading Terminals for Cryptocurrencies

No matter whether you are the CEO of a cryptocurrency trading company or a lone wolf trader, the cryptocurrency market offers enormous returns on investment.

While the belief that we can all get rich by investing blindly in cryptocurrencies like Bitcoin has now passed, savvy traders are still making huge sums of money by trading cryptocurrencies.

The fluctuations in the cryptocurrency market are huge when compared to fiat currencies.

Even the highly volatile GBP has only fluctuated from a 1.20 low to a 1.35 high against the USD in 2019. The rewards for traders remain low when compared to the “93 percent gain on a year-to-date basis” achieved by Bitcoin alone.

Because of this, traders and investors still require personalized trading terminals that allow them to trade in their preferred cryptocurrencies and fiat currencies.

Current solutions are improving day by day, however, with so much potential to improve existing solutions, customizable trading terminals will certainly be a lucrative market in 2025.

AI-Powered Trading Bots

As a CEO of a trading company with an existing trading solution, you will no doubt have seen that many of your rivals are in the process of or have already integrated an AI trading bot into their existing processes.

The reason for this is simple. Few experts deny that artificial intelligence will be one of the biggest industries and drivers of global growth within a decade or two.

When you consider that 46% of all fintech companies currently use some form of machine learning to power their software, the industry prediction that AI will power 95% of all customer interactions by 2025 comes as no surprise.

One area where AI is set to make a huge impact is in stock and currency trading. The race is on to develop ever more sophisticated trading bots in order that traders can reduce their exposure to risk while maximizing their returns.

Crypto trading bots have already proved just how much money can be made when they are powered by the right code and trading algorithms. Naturally, this requires the right expertise to develop them, particularly the algorithms that power their AI architecture.

This technology will continue to be a massive focus of development from 2025 onwards, as traders' companies look to get the edge over their competitors.

You can find more examples of businesses that have implemented a successful fintech strategy to evolve their products.

If you are looking to partner with expert developers for your fintech solution, you can easily get in touch with the experienced software developer community at DevTeam.Space. Write your initial fintech development specifications via this form and one of our technical managers will get in touch to further discuss the details with you.

Frequently Asked Questions on Growing Fintech Investments

Fintech is short for Financial Technologies. They are financial software solutions that aim to subvert traditional financial processes. An example is Transferwise, which has successfully overcome the international electronic money transfer system with its unique money pot system that doesn’t require individual money transfers.

It is entirely possible that FinTech companies such as Transferwise might just replace banks completely within the next 50 years. Banks and other financial institutions have been slow to take advantage of new technology, and this might cost them.

You can find top Fintech developers at DevTeam.Space. The platform’s community of field expert developers has successfully developed a number of Fintech applications.