- Developers

- Developer Blog

- Blockchain Development

- Why KYC Blockchain is a Good Verification Solution?

profile

By Aran Davies

Verified Expert

8 years of experience

Aran Davies is a full-stack software development engineer and tech writer with experience in Web and Mobile technologies. He is a tech nomad and has seen it all.

Wondering why is blockchain a good solution for KYC verification?

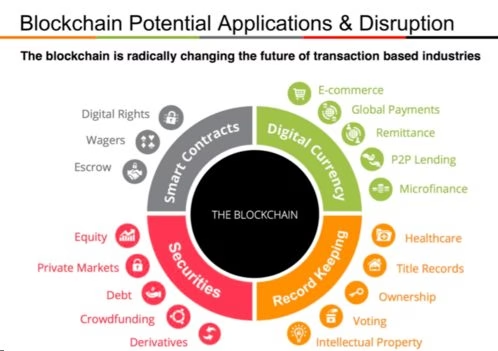

The automation of KYC verification stands to revolutionize international payments, an industry worth hundreds of billions of dollars a year.

KYC as we know it today

Identity can be easily established by government-issued documents such as driver‘s licenses, social security cards or passports, etc. However, a major challenge lies in establishing the authentication of other identification sources. Also, flaws in the security of such systems have led to repeated instances of financial fraud, money laundering, etc.

Irrespective of the severity of the use case, establishing identity through Know Your Customer or KYC verification, is a prolonged procedure.

In addition to the huge amounts of paperwork associated with undertaking such KYC processes, a lack of transparency regarding the use of the personal data collected from customers has led to inefficiencies in collating KYC data between parallel systems.

Global efforts to combat financial terrorism and money laundering have proved to be incredibly expensive for both governments and financial firms. Recent reports highlighted that in 2014, firms spent an incredible $10 billion on AML (Anti-Money Laundering) compliance alone.

Firms are also penalized for failing to comply with KYC regulations, through hefty regulatory fines, etc.

It is in this environment of volatility, ambiguity, complexity, and uncertainty that the financial sector is turning to blockchain solutions to help with KYC compliance.

The winds of change – KYC Blockchain

Although the financial services sector has been seeking solutions for the “identity problem for a long time, it is only now that a viable current KYC process has arrived in the form of blockchain.

A decentralized computing architecture, blockchain will allow for the accumulation of data from multiple authoritative service providers into a single immutable, cryptographically secured, and validated database.

Hire expert developers for your next project

KYC verification using blockchain has the potential to be faster, easier, safer, and more efficient than traditional verification procedures.

What is KYC Blockchain?

Blockchain technology allows for the creation of a distributed ledger that is then shared to all users on the network. This factor means that there is no one single authority and therefore a point of weakness, as in the client/server model.

This means that blockchain databases have an inbuilt immutably that makes the data that they contain far more trustworthy. Such databases can be used to store ID details of individuals which would be completely trustworthy.

If the financial services sector, for example, implements blockchain for KYC verification, they will be able to verify users quickly and reliably, via an app, etc.

Due to the reliability of blockchain databases, government institutions and companies could rely on the data completely, something which would remove the need for any further ID checks.

Here‘s how a KYC Blockchain application would work.

An institution, a bank, for example, sends a request to the blockchain platform to access your identity data.

In this new architecture, data access would be solely based on user consent. To grant consent, a user only has to log in, probably through a One Time Password (OTP), and allocate a private key to the data. Although the data can now be accessed by a third party (the bank in this instance), ownership of the data remains with the user.

The concept of the Blockchain-based KYC platform is already being implemented by IT giants like IBM. The Shared Corporate Know Your Customer (KYC) project assures an efficient, secure, and decentralized mechanism to validate, collect, store, refresh and share KYC information for customers.

How can Blockchain help with KYC verification?

In the future, blockchain-based KYC utilities will help bring cost savings to any industry that relies on identity verification. This is because the technology will allow banks and other financial institution to rely on a more secure organized unified model of data handling.

Let’s take a closer look at where the benefits lie.

Distributed user data collection

A KYC utility system based on blockchain technology will enable the financial and banking sectors to emancipate the process of identity verification.

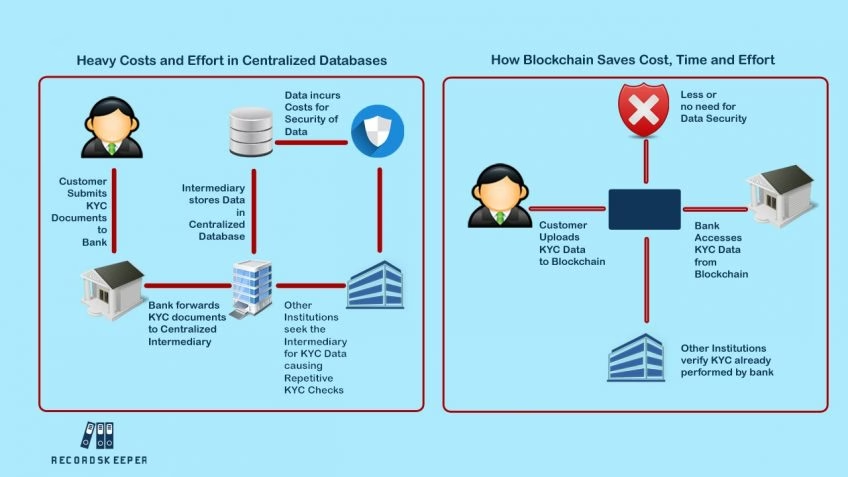

This is because presently, our data is collected and stored in a centralized system, such as a repository. Access to this data requires KYC providers to share their client data with the companies needing to access it.

With the introduction of blockchain solutions to handle the KYC process, data will be available on a decentralized network and can, therefore, be accessed by third parties directly after permission has been given.

This blockchain-based KYC system will also offer better data security by ensuring that data access is only made after confirmation or permission is received from the relevant authority. This will eliminate the chance of unauthorized access and subsequently give individuals greater control over their data.

Automation and standardization of policy/operations

Client data collection occurs on a daily basis among different organizations, businesses, and other institutions. From bill payments to booking tickets, our data (specifically name, address, social security number, etc) is required for nearly all aspects of daily life.

Taking into account the recent progress achieved on KYC policy standardization and the ever-increasing amount of data being collected, it is now possible for blockchain solutions to make use of smart contracts for the execution of control and operational processes.

Hire expert developers for your next project

1,200 top developers

us since 2016

KYC workflow routing can be coded into smart contracts and standardized across the industry, thereby streamlining the procedure. This will increase the effectiveness of the blockchain-based KYC system, as it would reduce the need for manual oversight.

Improvement in digitization techniques will also enable the implementation of multilingual solutions, with the help of translation tools and smart contracts.

Centralization of controls and risks

The financial sector can reduce risks by limiting the extent of human input. This can be achieved through standardization within the industry. Data owners will also be able to maintain oversight, as they will be required to directly authorize a company to access their data. This will also help to reduce the likelihood of mistakes or fraud.

Blockchain enables key regulatory concerns such as the AML risk ratings processes conducted by banks to be automated. This will help limit banks’ risk exposure and therefore help to mitigate risk.

KYC AML blockchain solutions, therefore, has the potential to bring about a big change in the way banks consider identity security and access. As such, blockchain KYC AML solutions are set to receive huge investment in the coming years.

Governance and data quality

Blockchain offers a robust hurdle against fraud. Once entered, data on the blockchain ledger cannot be altered. Data stored on the blockchain is secured by cryptography and cannot be altered without agreement by more than 51% of the network.

The current client/server system of data storage in financial institutions operates a silo-based system. This means the banks store the data on their servers for when it is needed.

Data can only be accessed via the banks’ internal system and not by any outside party. This means that the ID verification must be conducted by every single institution that is required to meet KYC regulations.

A blockchain solution, on the other hand, would allow the creation of a ledger that would allow the data to be stored on a single, universally accessible platform. Data could, therefore, be accessed by anyone with authorization.

This would lead to an improvement in data governance that could help institutions identify fraud earlier, etc. This would help prevent many of the financial crimes that banks face today and help them avoid hefty fines that are brought about as a result of compliance failures.

Communication and Transparency

Blockchain-based KYC platforms will allow for the active monitoring of everything from account openings to day-to-day transactions. When combined with smart contracts that will have predetermined criteria to spot fraudulent activity etc., these new platforms will be able to alert banks of any wrongdoings.

The immutability aspect of blockchain is also quite handy in the context of creating trust between parties involved in the KYC process. The ability to trust data stored on a KYC blockchain software solution removes the need for secondary validation processes or cross-checking.

Finally, a distributed ledger system makes the reporting and communication processes more efficient, saving time and money. Since parties can easily access reliable data and processes; mistakes and fraud can be detected far more quickly.

This is particularly true when it comes to mistakes, which with conventional systems, take a lot of time to be identified, reported, and solved.

Suspicious Activity Reporting

Currently, the banking KYC process takes days or even weeks. Due to this, the cost incurred by financial institutions in maintaining regulatory compliance is escalating rapidly as the industry tries to stay ahead of financial fraudsters or terrorists.

With a shared ledger, where numerous financial institutions are maintaining the ledger, the process of KYC could be easily adjusted and monitored by all parties. Any change or update to a client’s data would be available to all parties.

Having direct access to a shared ledger would help institutions save on the time-intensive process of having to identify a scam and report it.

Comprehensive Authentication Process

A cryptographic verification solution will help financial institutions quickly verify the identity of individuals. This is essential for data protection compliance as well as fraud prevention.

Meanwhile, the increasing demand for banks and other financial institutions to create apps to allow users to conduct online banking also poses new challenges. Security flaws presented by bugs or theft of our smart devices have created a need for a more secure decentralized solution that will address the security concerns of users.

Hire expert developers for your next project

The security offered by blockchain’s decentralized model makes the chance of fraud much less likely. While it might be possible for a hacker to access some sensitive information should the device be stolen, they would not be able to change the data thanks to the immutability of the blockchain.

KYC solutions for banks, in particular, are a game-changer as they offer increased security and customer satisfaction.

KYC Blockchain – The Scope of Application

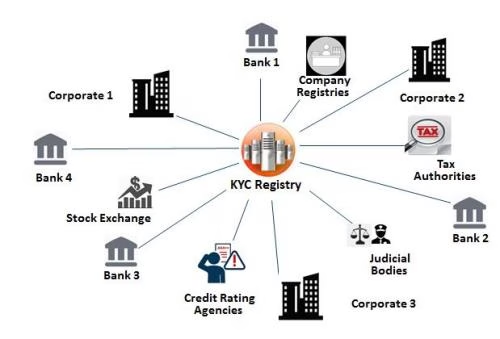

KYC blockchain implementation is not limited to banks or financial institutions. There is a wider scope of application among industries that require authenticated user identification.

The KYC registry on a blockchain could be accessed by many industries in addition to banks and other financial institutions. Many of these small companies and organizations require these data for different purposes such as verifying identifications before issuing membership cards, etc.

Tax authorities could also access it to speed up their internal processes. Other industries that require user data from such registries include judicial, credit rating agencies, stock exchanges, and so on.

KYC on a blockchain has the potential to be a billion-dollar industry. As I have already highlighted, technology giants like IBM have already invested in a massive blockchain project that is being built with the help of HSBC, Deutsche Bank, and the Treasuries of Cargill.

Final Thoughts

I have shown that blockchain technology can help improve KYC in many ways. It is clear that companies such as IBM have already recognized the advantages that this new technology possesses over existing systems.

Everything from the immutability of blockchain databases to their ability to help improve transparency in the verification of customers’ identities will massively help improve the process and reduce fraud.

Government bodies will also benefit as risk officers will have better access to data so the relationship between the financial sectors and regulators will be more transparent. This provides the provision for a massive reduction of financial fraud and crimes in the long term.

Only time will tell what the true impact of blockchain technology will be. It is, however, clear that the promise of this new technology has us all on the edge of our seats.

If you, as a business CEO or CTO, are planning to invest in a KYC blockchain verification solution, you are making a sound decision for the efficiency of your business processes. However, blockchain technology is new and its development requires a special skill set.

We would advise you to engage with a reputed software development company to help you with successful DApp development for KYC verification solutions using the right blockchain technologies.

DevTeam.Space can help you here with their experienced community of blockchain developers. Write to us your initial blockchain solution specifications via this form and one of our technical managers will get back to you to discuss further details.

Frequently Asked Questions on KYC Blockchain

Blockchain is already powering a number of KYC solutions. The most prominent example is blockchain’s use in international money transfers. Solutions are currently under development that will use blockchain-based ID authentication programs to help speed up the lengthy ID checks that the banks must undertake. Other solutions range from electronic medical records to home purchase solutions.

Due to the immutability of blockchain ledgers, it is the ideal solution for KYC. Provided that a person’s details are 100% verified before being stored on a blockchain KYC solution, there is no chance that they can be tampered with for fraud proposes.

KYC is certainly one of the areas that blockchain stands to benefit most. Arguably, however, the biggest use case will be international payments.

Alexey Semeney

Founder of DevTeam.Space

Hire Alexey and His Team

To Build a Great Product

Alexey is the founder of DevTeam.Space. He is award nominee among TOP 26 mentors of FI's 'Global Startup Mentor Awards'.

Hire Expert Developers